Tax Information

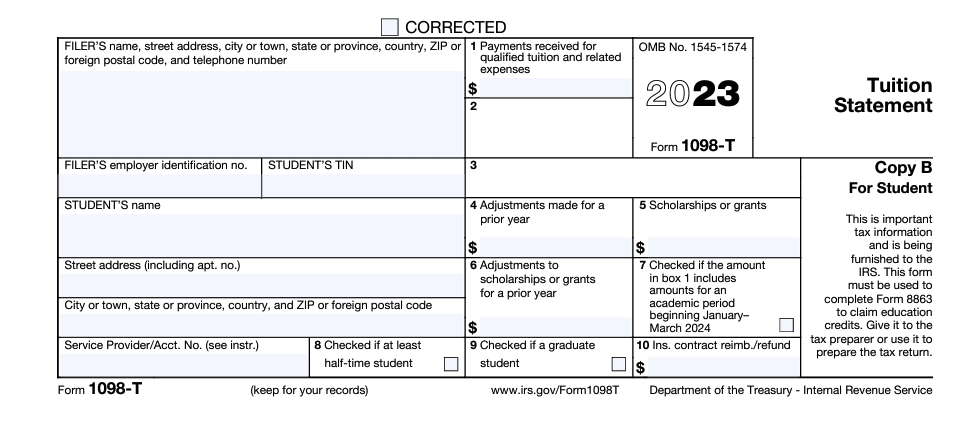

The 1098-T shows payments received for qualified tuition and fees during the calendar year as well as scholarships or grant aid applied to your account during the year. The 1098-T provides information you may need to claim education tax benefits that may be available to you.

What is the Form 1098-T?

The Form 1098-T contains data to help you calculate your eligibility for higher education-related tax deductions or credits on your personal income tax return. The IRS requires schools to report payments received for qualified tuition and fees during the calendar year in Box 1 on Form 1098-T, as well as scholarships and grants received on behalf of the student in Box 5. Receipt of a 1098-T does not automatically establish eligibility for educational tax deductions or credits, nor does it provide all information that might be needed to calculate any taxable portion of scholarships/grants received. There is no IRS or UNC Charlotte requirement that you claim an educational tax deduction or credit. UNC Charlotte cannot provide tax advice. You should refer to the IRS webpage or consult a tax advisor for further tax questions or advice.

Note on Payment Posted Date: Payments will post in the relevant tax year (i.e., a payment posted on Dec. 6, 2023 for the Spring 2024 term will appear on the 2023 1098-T). The posted date is based on when a payment was applied to the student account. Online payments through My UNC Charlotte, including payment plan payments, are posted in real-time. Payments that are mailed or wired (Flywire) may take an additional 5-7 business days to post. To assure these payments are applied in the current tax year, please allow for sufficient processing time. UNC Charlotte is unable to alter or back-date receipts.

Note on CARES Act, CRRSAA, and ARP Grant Funding and Student Emergency Fund Payments: These payments are not included in Box 5 since they are not required to be reported as scholarships or grants by the IRS. In addition, the University is not required to separately report the portion of emergency financial aid grants applied toward qualified tuition and related expenses.

FAQs

How will I receive Form 1098-T?

You will receive IRS Form 1098-T electronically if you meet the IRS’ reporting requirements in January. In order to receive your 1098-T electronically, you must consent to electronic delivery before December 31. Please:

- Log in to MyCharlotte

- Select the My Student Account block, select View Accounts and Statements

- Select Consents and Agreements under the My Account tab

- Read the consent form and click “Accept Consent” to agree to receive your statement online

To view, print, and/or download your current year or prior year Form 1098-T, please:

- Log in to MyCharlotte

- Select the My Student Account block, select View Accounts and Statements

- Select Statements under the My Account tab

- Click the 1098-T Tax Statements tab

- Select the action button next to the year to view

Can my authorized payer access my Form 1098-T?

Authorized Payers may also view your 1098-T statement electronically if you grant permission. To grant your authorized payer(s) access to view your 1098-T statement:

- Log in to the MyCharlotte

- Select the My Student Account block, select View Accounts and Statements

- Select Add Authorized User

- Enter email address of authorized user or select Edit in the column titled Action on the far right side

- Select Yes to “Would you like to allow this person to view your 1098-T Tax Statement?”

- Select Continue

- Follow instructions to complete process

Authorized Payers can log into the Authorized Payer Portal here.

What information makes up the total in Box 1?

Box 1 contains the sum of all payments, including loans, during the calendar year that paid for “qualified tuition and related expenses” for the year. For purposes of the Form 1098-T provided by UNC Charlotte, the following categories of charges are included or not included in “qualified tuition and related expenses”:

| Payments for the following are Included in Box 1 | Payments for the following are Not Included in Box 1 |

|---|---|

| Resident and Non-resident Tuition | Room and Board Charges |

| Graduate Program Tuition (Tuition Increments) | Health Insurance Premium |

| Undergraduate College Fees | Health Services Fee |

| Special Course Fees | Transportation Misc. Service Charge |

| Ed & Tech Fee | Course Related Books and Supplies |

| University Fees | Payment Plan Enrollment Fee |

| Safety and Security Fee | Late Charges and Other Penalties/ Fines |

| Food Services Misc. Charge | Matriculation Fee |

| 49er Card Service Charge | Parking Permits |

The following types of payments for “qualified tuition and related expenses” are included:

- Direct payments by cash, check, credit card, or wire

- Financial aid, including loans, credited to “qualified tuition and related expenses”

- Payments from outside sponsors/grantors

Why is Box 2 blank on my form?

Box 2 is blank because the IRS eliminated the option of reporting amounts billed. Starting with the 2018 tax year, schools have to report in Box 1 (payments received).

What is included in Box 4?

Box 4 is the sum of any adjustments made to “qualified tuition and related expenses” reported in a prior year. The amount represents a reduction in “qualified tuition and related expenses” paid during a prior calendar year. For example, if you paid Spring semester classes in December and withdrew from classes in January which resulted in a refund, Box 4 reports the decrease in paid tuition due to the withdrawal. The amount reported in Box 4 for adjustments to qualified tuition and related expenses may reduce any allowable education credit you may claim for the prior year. See IRS Form 8863 or IRS Publication 970 for more information. If this box is blank, then no adjustments were made for the year.

What is included in Box 5?

Box 5 is the sum of all grants and scholarships administered and processed by the UNC Charlotte Financial Aid Office during the calendar year.

The amount reported in Box 5 does not include:

- Tuition waivers provided during the calendar year, e.g., faculty/staff waiver, military waiver, non-resident graduate assistant tuition differential waiver

- Student loans

- Work-study compensation

- Scholarships, grants, reimbursements or other types of sponsorships not administered or processed by UNC Charlotte’s Office of Financial Aid

The amount of any scholarships or grants reported for the calendar year and other similar amounts not reported (because they are not administered and processed by UNC Charlotte) may reduce the amount of any allowable educational deduction or credit that you are entitled to.

What is included in Box 6?

Box 6 is the sum of any reductions made to grants and scholarships reported in a prior year. If this box is blank, no adjustments were made for the year. The amount reported in Box 6 for adjustments to scholarships or grants may affect the amount of any allowable educational deduction or credit you may claim for the prior year. See IRS Form 8863 for how to report these amounts.

Attaching Form 1098-T to Your Tax Return

You are not required to attach IRS Form 1098-T to your tax return. The IRS Form 1098-T is not like the IRS Form W-2 obtained from your employer, which is required to be attached to the tax return filed with the IRS (if not filing electronically). The 1098-T is an informational return for the student and has been provided to the IRS.

Why did I not receive a form?

If you do not have a qualifying transaction, then you will not receive a Form 1098-T. Students whose qualified tuition and related expenses are entirely waived will not receive a form 1098-T.

How do I update my SSN?

In order to have your social security number shown on your Form 1098-T, it must be provided to the University before the Form 1098-T is processed. To update your SSN, view our forms and select Demographic Change Request to make your entry. Be sure to upload a copy of your original, signed Social Security Administration SSN card using the “attachments” button located at the bottom of the form.

As an alternative you may mail a completed Form W-9S to the Office of the Bursar for processing of the SSN / ITIN.

Office of the Bursar, Reese 222, UNC Charlotte

9201 University City Blvd., Charlotte, NC 28223

Please include your Student ID in the top margin of the form.

You may also bring your forms / documents to Niner Central on campus at 380 Cone Center

Do NOT email your SSN/ITIN or forms to the University. Emailed forms will NOT be accepted.

Need help?

If you have questions regarding your 1098-T tax form, please contact Niner Central. If you have general questions for our 1098-T Servicer, ECSI, please connect with a live Customer Service Representative or you can call them at 866-428-1098 to speak with a representative.

If you need to create a profile & account with “key” from ECSI in order to access your 1098-T, please follow these detailed instructions.

If you cannot locate your “key” issued by ECSI and need to obtain one, please contact them at 866-428-1098.